How Other Lenders Could Be Costing You Thousands

How To Save Thousands Of Dollars With

The Right Construction Financing

Not every lender is the same. Quite frankly, in the realm of new construction there are very dramatic differences among lenders. We suggest selecting a lender that works with you and your builder to customize a construction loan that works best for your individual needs, rather than fit a cookie cutter stamp for their own convenience.

We also suggest selecting a lender that is experienced in dealing with new construction. Inexperienced loan officers and banks or mortgage companies that have limited construction lending experience can set the stage for both financial loss and emotional crisis.

Why Mykala Mortgage?

Don't take our word for it,

hear what our clients have to say!

.png)

Construction Loans

If there is one loan program I have always loved, it's construction loans. I think it is because I have built a home, remodeled two homes, and had countless rehab projects on investment properties. While I won’t proclaim to be the best carpenter, I do know my way around the construction arena and have written millions of dollars in construction financing.

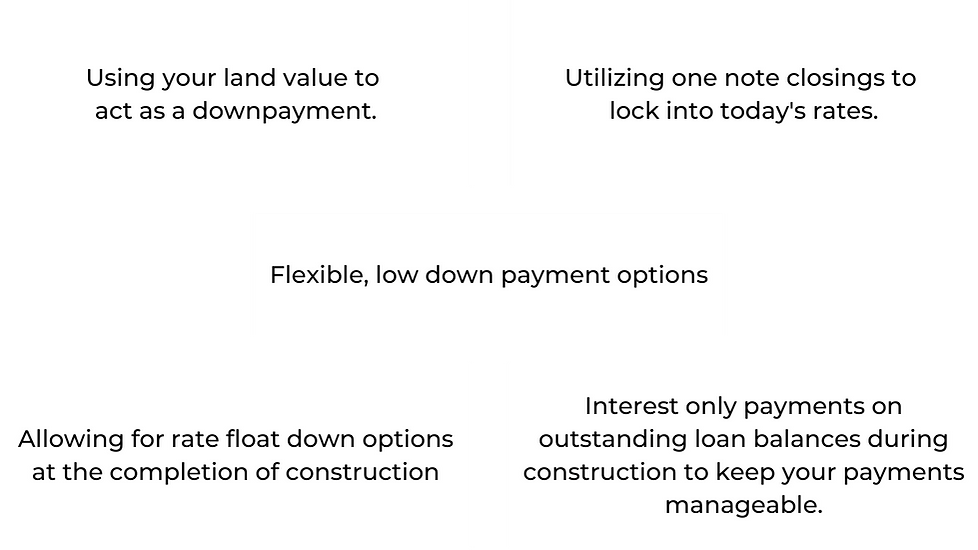

With more than 2 decades of lending experience, I can honestly say that Dart Bank has the best construction programs that I have seen in my tenure. When you work with our bank in Chelsea, MI, construction loans offer tremendous flexibility:

-

Down Payments with less than 20%

-

One time closings that help save on costs and lock into interest rates

-

Builder friendly draw process

.png)

.png)

.png)

.png)

.png)

.png)

.png)